Prince Frederick Maryland 2024 Housing Report

Click this link to download the full report City-PrinceFrederickMD-202411

FOR OTHER CITIES IN CALVERT COUNTY CLICK BELOW

Does The Govt Have A Plan To Save The Housing Market In 2024?

Last week Tim and I discussed several proposals from Whitehouse.gov on how the Biden Administration plans on bolstering the housing market. It is not clear what has passed and what was only proposed but honestly nothing proposed looks like it would have much effect.

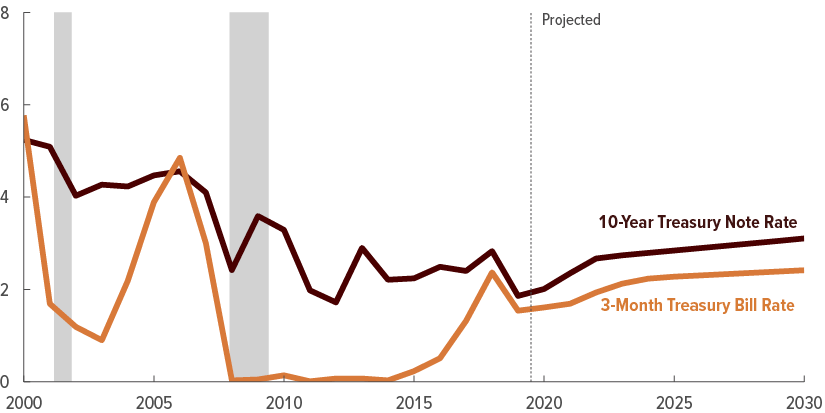

There is a catch 22 with interest rates. First of all they are not set by the actual Federal Government so there is that but most people understand that the Govt can pressure the Fed at times and right now it looks like nothing is going to change.

The catch 22 (according to the Fed) is that if you lower rates you increase inflation and the cost of eggs and automobiles goes up even faster. But if the cost of a car went up 5k and you could get a 2% interest rate, the payment would be lower and it would feel cheaper. It’s a vicious cycle and it’s basically what happened to housing from 2018-2022.

* This is not a political knock on Biden Administration vs Trump BTW I have no idea what Trump proposes, this is only our analysis of what the Govt has proposed publicly.

So if rates go down, houses go up even faster and round and round we go. What will ACTUALLY help? We discuss our ideas at length with several proposals from restructuring existing loan programs to incentivizing the building of affordable homes.

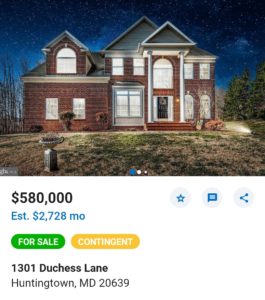

If you are considering buying or selling this year let me be frank, the buyers are still struggling because of affordability and sellers are still getting the upper hand. Houses are sitting a tad longer on the market but are still selling if priced correctly.

Housing prices have increased 5.9% in the state of Maryland in 2024 and no one is expecting them to crash anytime soon. It’s better to lock in the price and ride the equity until we get a break on interest rates. As prices continue to increase, at lease you are locked in.

BTW That’s the same advice people have been ignoring for the past 5 years, how has that worked out???

My Response To The NAR Lawsuit

What’s Going On + My Thoughts… |

|

I have read ton of articles, communications from NAR, MAR, SMAR, eXp, and I have watched hundreds of YouTube videos about the recent changes in the real estate brokerage industry. I would like to address my past and future clients as well as the general public about this NAR (National Association Of Realtors) lawsuit. I will relay some details as I understand them and give my perspective as someone who has been in this business 15 years. *My summary is at the very end if you want to just skip ahead The LawsuitI was recently told that if you have bought or sold a home in the past 5 years you have or will receive a postcard letting you know that you are part of a class action lawsuit. You will be receiving compensation as a result of a settlement (unless you go through the trouble of opting out.) I am sure you have read the headlines that “6% commissions are dead FINALLY!” or have read something in the news that the real estate business is finally getting what they deserve. We (Realtors) have recently received a communication from the National Association of Realtors letting us know that several changes are coming pending a judges approval. The lawsuits are not over and the settlements and changes are not final but many of the changes have been agreed to by both parties. Do you care? Maybe or maybe not but if you are planning on buying or selling a house in the future, it will be different than it was in the past. If you are buying or selling in 2024, this is a MUST read. I believe that this whole thing is unamerican. That’s a big statement and it sounds like it’s coming from a whiny Realtor who is getting their “over inflated” commissions taken away. Neither of those statements are true, hear me out. How It Worked In The PastFirst let me explain what happened and how all this works. I need to set up the context in order for you to make sense of this. Starting in 1996 in Maryland, if a home seller hires a licensed Realtor:

That’s what happens most of the time and that scenario (where the seller agrees to pay the listing agent and ends up paying the buyers agent some of that money) is the premise the DOJ and a class action attorney used, that led to a settlement by several real estate companies and NAR. The lawsuit is not signed by a judge and the DOJ has not agreed to a settlement at this time however we expect the judge to agree to a new set of changes for how our industry does business. The issue at hand was the fact that NAR and real estate companies were supposedly working together to keep commissions high and by requiring there to be a fee paid to a buyers agent. The amount could not be $0, it could be $1, but not $0. It can be $0 as of today btw. According to the accusation anti trust laws were violated. I am not going to say I know how those laws are written. Perhaps if NAR had not required compensation and allowed sellers to choose $0, we wouldn’t be here. Nonetheless, lawsuits were filed and a settlement was agreed to by both parties. What’s Different?There two major changes so far: #1. Listing agents are not allowed to advertise a fee being paid to the buyers agent in the MLS. This is an attempt to “decouple” the commission meaning they want the buyers to pay the fee or the fee to be negotiated at the time the offer is written. Fair enough. Is that a good idea? We will soon find out. This does not mean the seller is not allowed to pay a buyers agent? No it means they don’t want the fee advertised on the MLS. How will it work? We do not know but I think it will make buying a house more of a nightmare than it already is. #2. Buyers will be required to sign an agency (representation) agreement before seeing any home with a licensed Realtor. No more hey call a Realtor and lets go see this house in person and expect to be let in no questions asked. The Future For Buyers & Sellers {This all goes into affect mid July 2024} How will this change the way homes are sold as a seller?

BTW If buyers agents go away, (I think they will) buyers on a tight schedule will be seeing fewer houses and your listing will be shown to fewer buyers as a result. We will need to figure out who shows the houses to the buyers if there is no buyers agent being paid. Listing agents can not show all of their listings every time someone wants to see it. Buyers agents are set up show buyers several houses at the same time. If they are forced to rely on the buyers to pay them, they will be getting another job within 6 months… How will this change the way homes are sold as a buyer?

Who deals with the buyer to set expectations and guide them?

The End Result?

Is This A Fair Outcome?As a result of the settlement you are likely going to be receiving a whopping $21! The attorney who said Realtors were making too much money will make 600 million dollars on the first round of lawsuits, seems totally fair… Bigger Issues?

So houses cost more than ever and the DOJ decides destroying buyers agents is the solution? People Have Had Options All AlongCan you hire a discount brokerage? Sell your own house for sale by owner? Negotiate the commission with any Realtor? Redfin hello??? Type in “sell my house for cheap” in Google or skip it because I already found one right here in Maryland, https://homerise.com/ and you can sell your house for $95! And if you want to by all means go for it, this is America, more power to you. Better yet do it for FREE on Zillow LINK In 2023, during the strongest sellers markets in the history of earth, an all time low of only 7% of sellers chose to go it alone and sell for-sale-by-owner. Do most people sell their own cars knowing that you can sell it for way more than you can get for it as a trade-in? Why not? The same reasons people hire real estate agents, they are afraid to screw it up and don’t want to deal with everything involved. Selling a car is WAY easier than selling a house. *SummaryIf you bought or sold a house in the past 5 years you are most likely getting $21 as the result of several class action lawsuits. It stated that real estate brokers, because of rules from the National Association of Realtors, forced home sellers to put at least $1 in the listing agreement to pay a buyers agent and therefore forced high commissions. NAR and several brokerages agreed to settle without admitting guilt for hundreds of millions of dollars. The class action lawsuit for homebuyers (who typically pay nothing for buyers agent representation) is marching forward in a separate multi billion dollar lawsuit because they were damaged somehow. How? I don’t know because I haven’t read that one yet. The legal basis for the lawsuits and the communications by the plaintiffs attorneys are different. The communication to the media has been that Realtors get paid too much and they (the attorneys and DOJ) are going to break up the industry by forcing us (Realtors) to change how or by whom we are paid. They are trying to prevent sellers from paying the buyers agent and supposedly this will save everyone money. In reality if a seller can sell without paying a buyers agent they will understandably. Most buyers will choose not to pay for a buyers agent or for financial reasons will be forced to deal with the listing agent directly and will therefore be unrepresented when buying a home. & In ConclusionThis is stupid and unamerican because every seller signed the agreement that outlined exactly who was getting paid and how much. At the settlement the numbers came out exactly how it was written in the listing agreement. If they wanted to, they could have said I am calling Homerise.com and paid $95 but they didn’t, they signed and paid what everyone agreed to, like we do in a free market society. In the past 5 years sellers are making small fortunes every time they sell a house compared to the previous 50 years of home appreciation. They did not ask for this. So now we are stuck having to figure out how to negotiate commission at the offer table? In reality, a trial lawyer found a loophole and pulled a fast one on everyone by attacking the real estate trade group (NAR) industry bi-laws. He is raking in a cool 600 million by telling previous home sellers that they were tricked into paying Realtors when they sold their house. This is despite the fact that they agreed to it in writing. They will all be getting $21 he is getting 600 million and again who got tricked??? The world we live in loves the people “making too much money” getting “justice” so I get it. Maybe 30k to put a sign in a yard seems like a lot, maybe everyone should have called Homerise and maybe they will. Or maybe they will still choose to call someone who has been doing this for years helping hundreds of families get through this process. Which by the way, according to this article that states that selling a home is considered less stressful than a week in jail LINK What Will I Do?Continue to focus on helping home sellers get the most money when it comes to selling their homes using a process unlike anyone in the area where I pay for a pre-appraisal, pre-home inspection, a consultation with a professional decorator, use the best photos, video, and social media marketing for listings in the area. I will help my sellers negotiate from a position of strength and we will get top dollar! My clients will sell their houses faster and I will make it as easy and stress free. They will get more money when selling their house than if they never hired me. Will I still help buyers? Yes, but I know the harsh reality is that most people do not have enough money saved to pay the down payment, lender fees, appraisal, taxes, transfer fees, title fees and still have room for a Realtor. I hope they come up with a solution to finance the fees or perhaps home sellers will agree to keep paying. If not I will always take care of my people who are loyal to me and I will do whatever I can to help them. I do have a family to consider and like you, I will make my decisions based on what is best for them. Thank you for listening to my ted talk. |

|

Alternative Mortgage Programs In Maryland 2024

In 2024 there are lots of different ways to buy a house without 20% down and we are not talking about FHA or VA. We are going to discuss what programs are out there that people don’t know about that can help you if you are thinking about a home in 2024.

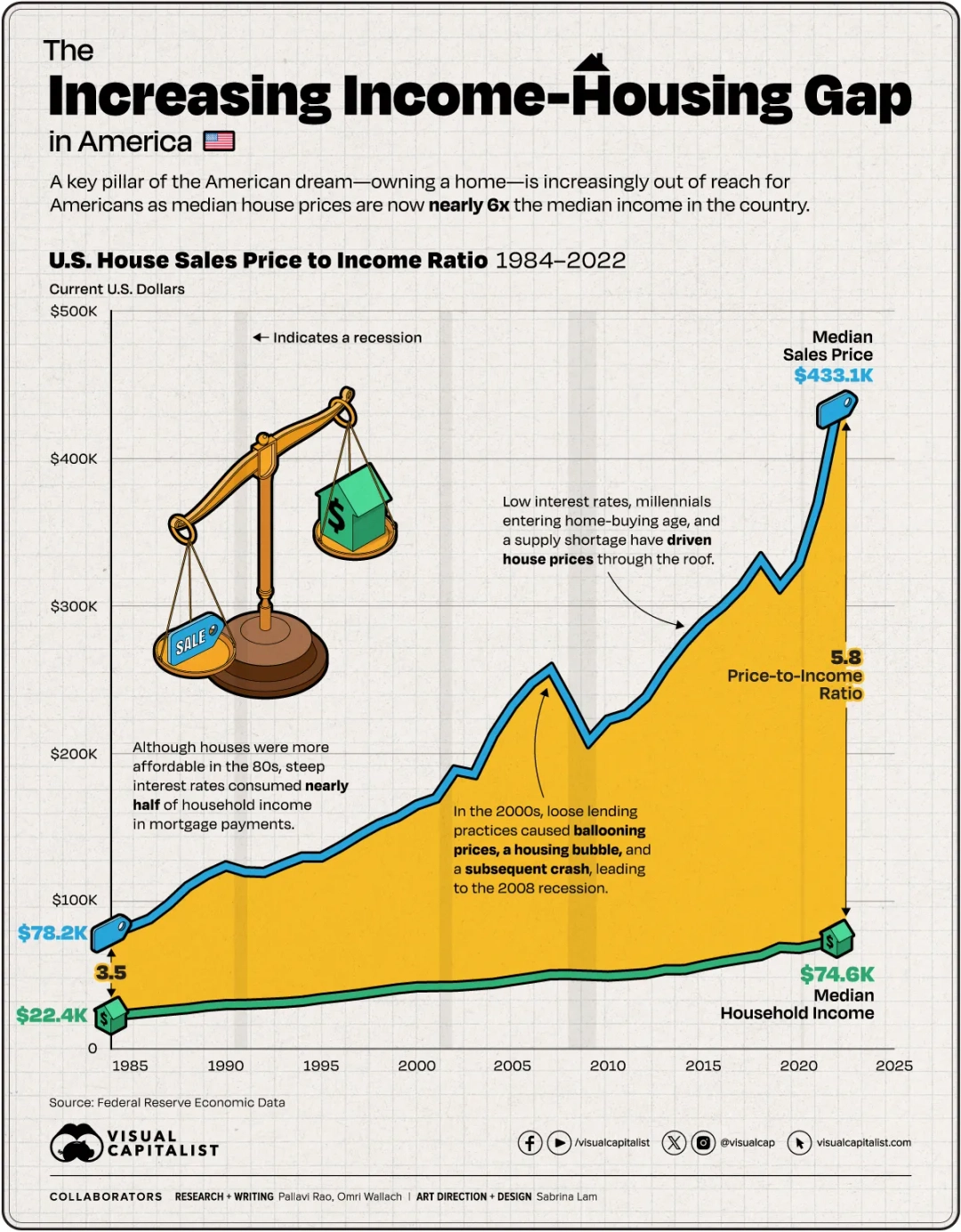

The REAL Story Of Increased Rates & Increased House Prices

So What’s The REAL Story Of Increased Rates & Increased House Prices? |

|||||||||||||||||||||||||||||||||||||||||||||

|

People hear the news and think the market is bad but they hear other people telling them the market is great. At the end of the day over 2/3 of homes purchased are purchased using a mortgage and this is where the real impact is felt.

|

|||||||||||||||||||||||||||||||||||||||||||||

Md Suburbs Home Prices Over 5 Years

|

|||||||||||||||||||||||||||||||||||||||||||||

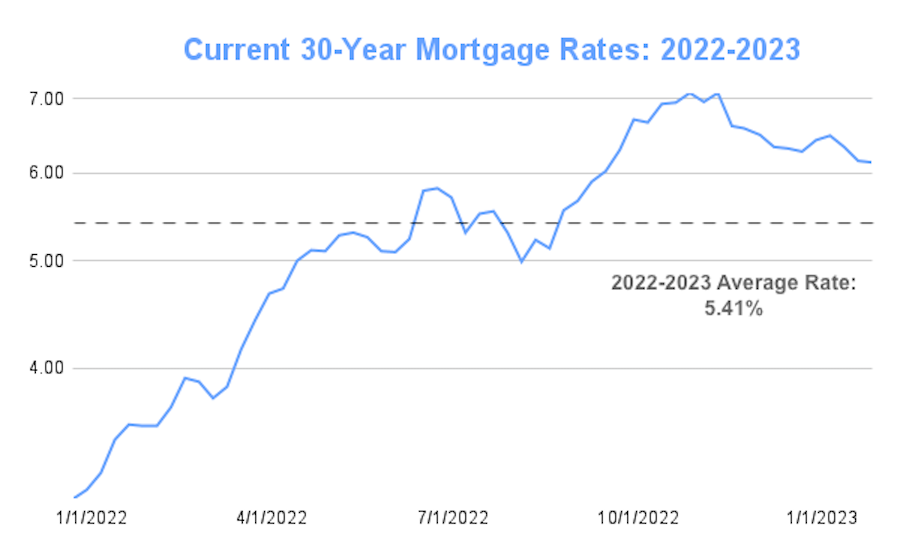

Mortgage Rates Past 12 Months |

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

Okay, So What? |

|||||||||||||||||||||||||||||||||||||||||||||

|

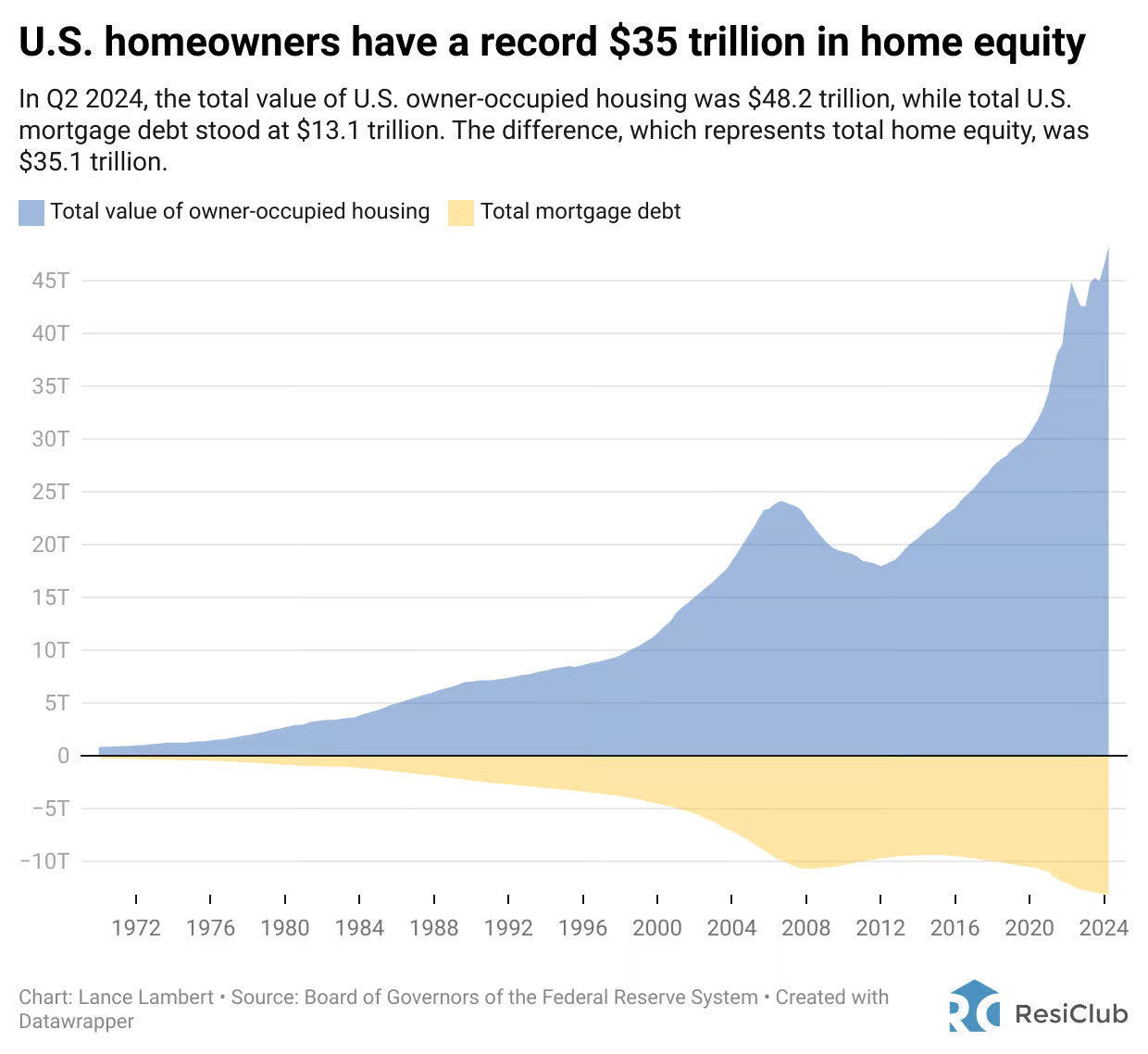

Here is the problem… Rates have more than doubled causing payments to go up 50% in just 12 months THEN Home prices have increased by over 50% in the past 5 years So… payments on houses are DOUBLE what they were! |

|||||||||||||||||||||||||||||||||||||||||||||

#Real Numbers# |

|||||||||||||||||||||||||||||||||||||||||||||

|

Okay so a 300k house in 2018 is now 500k and the payment went from $1,800/month to over $3,600/Month!! How about a 600k home? Here is where the problem is… a two-income family making 150k could easily afford a 600k mortgage 5 years ago when it was under 3k per month – easy peasy lemon squeezy! Now? It’s almost $7,000 a month for the same house which now costs $900,000! That’s a HUGE problem and it’s the reason the top of the market is struggling right now. It’s also the reason sellers in that house won’t sell it because a similar house cost $7,000 a month… 😬

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|

P.S. It’s more important than ever to have a trusted advisor helping you in this market. If you or someone you know needs top dollar for their home, text/call me 443-624-9398 |

|||||||||||||||||||||||||||||||||||||||||||||

To Upgrade Or Not Upgrade

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

So Far 2023 Is Meh But Picking Up Steam

Mortgage Application Are Down 39% |

|

So there is certainly no boom but there is also no bust going on in the real estate market. While mortgage applications for new purchases are down 39% compared to last year, they are up compared to recent weeks. Rates dipped to 6.2% which is the lowest since 9/22 which has caused an uptick in both purchase and refi applications from earlier in January. The most recent forecast is that sales will be down to the lowest levels in over 10 years mostly because rates and home prices have created an environment where only those who NEED to move are moving. No one is going to choose to move across town and give up a 3.25% rate, deal with all the costs and headaches of moving, and then get into a 6.25% rate unless there is a compelling reason. What does it mean? It means there are fewer buyers and sellers and things are going to be very different but not bad. Sellers are price-dropping and paying closing costs for the buyers but there is no drastic value drops and we are NOT in a buyer’s market. |

Homebuying Hacks 2023

When most people think of investing in residential property, they think about buying a small house and renting it for a few hundred dollars over the mortgage.

The main problem with that plan is that in the current market, finding a house that will rent at a profit after a 6.5% mortgage is much tougher than it was a few years ago.

That’s before considering what if you go a few months with no renters, something major breaks, or you have a bad renter, (I have stories!!!) you can put your profit at serious risk.

This is why most people are not willing to invest a large portion of their savings into a residential rental property.

But…

There are more than a few ways to get into a property with less than 20% down on a risky investment.

Here is a summary of a few of the ideas we discussed in this week’s podcast

House Hacking – Rent every room individually. People are paying up to $1,000 a month for room rentals because the market for cheap rentals is so tough. A 4-5 bedroom house can make serious money with the right setup.

Non-Traditional Partnerships – Instead of buying a house as an individual or as a couple, buy a house with a friend or two and split the expenses. For many, this is much more desirable than renting or taking on a mortgage by themselves.

Own/Airbnb – Tim and I discuss a couple in Annapolis who have a new property with a $2,000 mortgage. They can rent the house for the Naval Academy Graduation and Annapolis Boat Shows for $3,000 a week. During the 4 weeks, they will cover 50% of the annual mortgage.

Traditional Airbnb – People assume Airbnb’s are only for seaside towns or places near major attractions but that’s not true. People rent basements, garage apartments and are also looking for “primitive” sites with no amenities and are willing to pay big bucks. Got an old shed at the back of the property?

To Sell Or Not To Sell, That Is The Question…

To Sell Or Not To Sell, That Is The Question…

Here is my advice:

If you NEED to move but are not sure when. The answer is yesterday, then today, then tomorrow in that order. Not the day after… I think every day that goes by will be worse than the previous day. Carpe Diem!

If you have an investment property and you don’t want to keep it for more than 5 years, sell it immediately. See above

If you have a property covered under a lease, incentivize your tenant to move. Give them cash, detail their cars, pay some of their student loan debt etc. Trying to save 5k and potentially losing 10% of your home’s value waiting until next year could cost you tens of thousands.

If you want to move but don’t have to move, you are likely not moving anyway because the payments on houses have doubled. Only people who NEED to move will jump in.

If you want/need to BUY and are thinking about waiting. DON’T WAIT! The Fed said they will raise rates two more times in 2022 and again next year.

If you are looking to purchase an investment property, wait. There will be deals, now is not the time to jump. Hang on

If you own your home outright in cash and want to move. I would sell it and rent where you want to live for at least the winter and see how things go.

You can write the lease in a way that allows you the option to break it and that way you can look for deals. Rent and wait for the perfect house that will likely cost less than it does today.

Bottom line_______ Tomorrow will NOT be better than today for anyone